Yearbook 2013

Luxembourg. An eavesdropping and corruption scandal that was unveiled in July usually shook Luxembourg calm and caused the government to fall. A parliamentary inquiry presented information that the intelligence service SREL bought luxury cars as bribes and listened to politicians, activists and businessmen. Prime Minister Jean-Claude Juncker was accused of failing to monitor SREL properly. He was considered have spent too much time on the assignment as chairman of the Eurogroup, an assignment he left at the beginning of the year.

According to Countryaah, the scandal prompted the Socialist Party LSAP, which was a member of the coalition government with Juncker’s Christian Democratic CSV, to demand fresh elections. Juncker, who had been prime minister for 18 years, announced his departure but remained as acting head of government.

The new election was held in October. CSV lost some, but remained the biggest party with 23 of the 60 seats. LSAP and the Liberal DP were given 13 seats each and the Green Party 6, and the three parties decided to form government together. Luxembourg thus got its first government without the Christian Democrats since the 1970s. In early December, the new government took office with Liberal Xavier Bettel as prime minister.

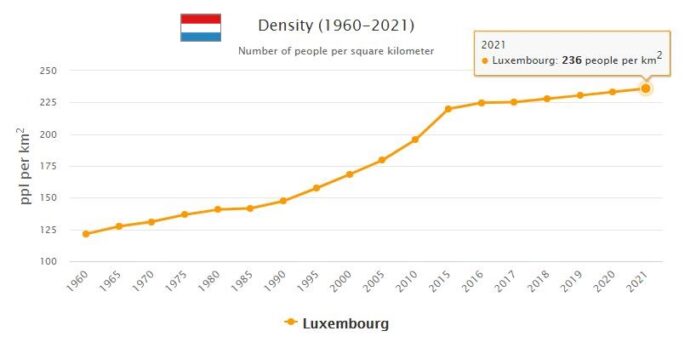

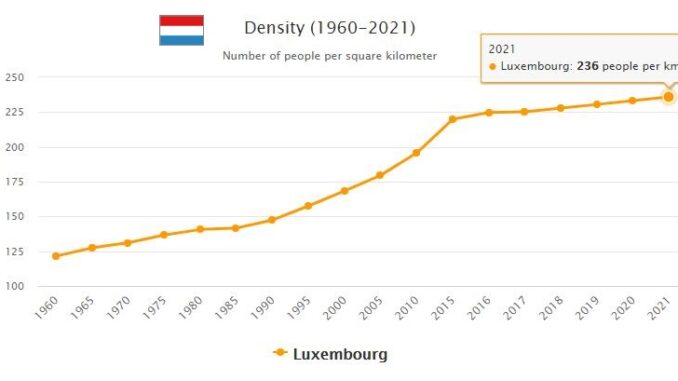

Population. – At the 1991 census the population of the grand duchy was 385,317 residents (149 residents / km 2). During the first half of the 1980s, the annual population growth coefficient was on average negative (−0.1%) while, towards the end of the decade, there was a certain recovery in natural population growth (in 1990: coefficient birth rate 12.9ı; death rate 9.9ı). The contribution of foreign labor (in Luxembourg there are over 95,000 immigrants, of which about a quarter are Italians) remains fundamental for the Luxembourg economy. This was heavily penalized by the crisis that hit the steel industry starting from 1974. The production of cast iron and ferro-alloys (2.6 million t in 1990) and steel (3.6 million t) is in decline and the workforce employed in the sector decreased over the course of the 1980s from 17,000 to just over 5,000 employees. In 1982, the exploitation of local iron mines ceased, and now the raw material is entirely imported (mostly from France). To reconvert the structure of the national economy, Luxembourg has given a strong impulse to the tertiary sector. Very advantageous tax legislation vis-à-vis foreign capital has attracted a large number of financial institutions and banks, mostly foreign, to the capital of the grand duchy, which has risen to the role of a world-class financial center. The sector’s revenues now provide enough currency to cover the trade deficit and keep the balance of payments in surplus. The abundance of capital invested in this tax shelter also had the effect of favoring the birth of new industrial companies.

- According to AbbreviationFinder.org, Luxembourg is the capital city of Luxembourg. See acronyms and abbreviations related to this capital and other major cities within this country.

Economic and financial policy. – After a long period of adjustment, during the 1980s the Luxembourg economy was characterized by sustained growth and a process of diversification of the productive structure. The growth rate of the gross domestic product (about 4% between 1983 and 1992) was overall higher than that of the main European partners ; the unemployment rate (1.3% on average in the 1980-92 period) was among the lowest in the industrial area. The current account balance also presented continuous surpluses, while the public finance was substantially in equilibrium.

This evolution appears relevant if we consider that in the past the Luxembourg economy was largely dependent on the steel sector, a sector which, in addition to a historical decline, particularly suffered from the recession of the world economy in the early 1980s.. Moreover, like other non-oil countries, the terms of trade worsened following the two oil shocks of the 1970s.

The economic recovery was made possible not only by an effective economic policy, but also by the growing importance which, with the greater freedom of capital movements, the offshore financial centers have assumed. This has meant that international banking, also facilitated by a favorable regulatory and supervisory structure, has become the main activity of Luxembourg, replacing the steel sector.

Given the close links with Belgium, Luxembourg’s economic policy was mainly implemented through fiscal policy, which influenced both growth and the extensive process of economic restructuring. The substantial balance of public finance has allowed fiscal policy a high degree of flexibility. Periods characterized by financial surpluses alternated with phases in which public spending was used for expansionary purposes. Fiscal policy has also made it possible to implement a reallocation of resources in favor of investments, which resulted in the 1980-85 period equal to 25% of GDP, five percentage points, that is, above the average of the other EEC countries.

The recession that hit the international economy in 1992 was also reflected in Luxembourg, causing a general slowdown in its economic dynamics: GDP grew by only about 2.5% and the growth rate of domestic demand passed from 4.8% in 1991 to 3.7%.